by

"What we are proposing to

do is to build Thailand's first potash mine," says Asia Pacific Potash's

Engineering Manager Donald Hague. "In fact, it's the first significant

potash mine in South-East Asia." And potash is essential to agriculture

development as it is one of the basic nutrients for plants.

"What we are proposing to

do is to build Thailand's first potash mine," says Asia Pacific Potash's

Engineering Manager Donald Hague. "In fact, it's the first significant

potash mine in South-East Asia." And potash is essential to agriculture

development as it is one of the basic nutrients for plants.

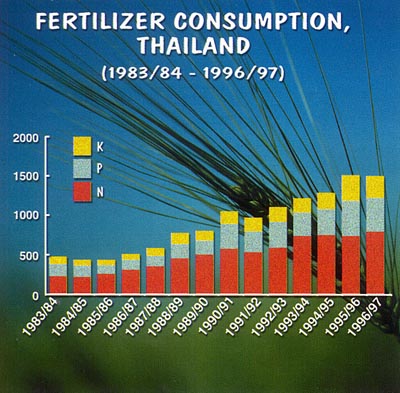

"In the western world

consumption is stable. But in Thailand and Asia the consumption of fertilizer is

rapidly increasing, and the consumption of potash is increasing even

faster," says Mr Hague. "But none of the countries in South-East Asia

have a domestic source of potash. At present, it is all imported from North

America, the former Soviet Union and the Middle East.

"We initiated this project

by exploring for potash in the Udon Thai Potash Concession Area where we

successfully identified a sylvinite deposit which is a high-grade potash ore

sufficient to support at least one 2 million tonne/annum mine and possibly even

a second and a third. Ultimately, this puts Thailand in the position to be the

third largest potash producer in the world (Canada is first, the former Soviet

Union second), as well as enabling it to be Asia's only significant source of

potash."

The company hopes to start

construction of the mine next year and that will put initial production in the

year 2003. The mine is expected to last over twenty-five years and produce two

million tons a year. Of that total, 400,000 tons will be used for domestic

consumption, and 1.6 million tons will be exported to other countries in

South-East Asia. The growth of the potash market in this region is so

substantial that those two million tons can easily be absorbed into the market

(11 million tons were delivered in 1998 with a predicted growth of five million

more tons expected over the next five years).

Asia Pacific Resources, of which

the Asia Pacific Potash Corporation is a subsidiary, is a member of the Crew

Group of Companies which is natural resource based and is into activities

ranging from early stage exploration to operating mines with its focus being on

the development of new mines and in some cases the optimization of existing

mines. The potential for potash exploration in Thailand was well-known back in

the 70s. The Thai Government set aside various concession areas and signed

various deals with companies to do exploration in a number of areas. But in the

1980s, the potash industry went through some rough times, and because of the

turmoil, however, nothing much happened.

Asia Pacific Resources, of which

the Asia Pacific Potash Corporation is a subsidiary, is a member of the Crew

Group of Companies which is natural resource based and is into activities

ranging from early stage exploration to operating mines with its focus being on

the development of new mines and in some cases the optimization of existing

mines. The potential for potash exploration in Thailand was well-known back in

the 70s. The Thai Government set aside various concession areas and signed

various deals with companies to do exploration in a number of areas. But in the

1980s, the potash industry went through some rough times, and because of the

turmoil, however, nothing much happened.

What turmoil? "You see," Hague explains, "in the 80s there was a tremendous oversupply of potash and a tremendous collapse in consumption, particularly in the former Soviet Union. What that led to was price wars, decreasing product prices, bankruptcies, and the traditional consolidation that accompanies such a downswing. Since then, the Canadian industry has consolidated from some twenty suppliers down to two or three major ones. And throughout the world, you've seen the same consolidation and same rationalization of production in various places. For example, in France, production dropped off considerably because of diminishing resources, the high cost of mining and processing. The industry has really rationalized its production. Potash is probably one of the only industrialized minerals to increase in price over the last few years."

Most people are familiar with

fertilizer and its benefits, as it provides the three major nutrients for plant

life: nitrogen, potassium, phosphate. Nitrogen is widely available - a typical

form is urea. Potassium is available out of potash. And phosphate is also a

mining product and available in various forms. None of these products are

substitutes for the other. In fact, you need a mixture of all three, depending

on the soil conditions and the particular type of crop you are trying to grow.

Experts can analyze your crop and soil conditions tell you the blend of three

constituents you should use.

What has happened in Asia is

that because nitrogen and phosphate have been readily available, countries have

used them as base fertilizer and that has achieved good results in the short

term, but in the long term you need to compensate for the lack of potassium. For

example, in China where a lot of research has been done, the ratio of potassium

is half what it should be, so in the long-term China has to look at doubling its

potassium levels. Balanced fertilizer results in much more substantial plant

growth.

What has happened in Asia is

that because nitrogen and phosphate have been readily available, countries have

used them as base fertilizer and that has achieved good results in the short

term, but in the long term you need to compensate for the lack of potassium. For

example, in China where a lot of research has been done, the ratio of potassium

is half what it should be, so in the long-term China has to look at doubling its

potassium levels. Balanced fertilizer results in much more substantial plant

growth.

In the early stages, APPC's

focus has been on carrying out the exploration, drilling, and the identification

of the potash horizon, collecting all of the technical information to build up

resource models and providing the basic underground information in order that

consultants could take it a step further and carry out the preliminary design

and costing of the whole facility.

Back in 1993, within its first year of official exploration, APPC was very successful with its drilling, as it had very good indications of potash which allowed the company to raise additional capital to continue the exploration programs and feasibility studies through to the point where it spent close to US$30 million on exploration, feasibility studies and preliminary designs culminating in 1998 when it completed a bankable feasibility study which is essentially the pulling together of all the different capital cost elements including marketing studies and financial and transportation modeling.

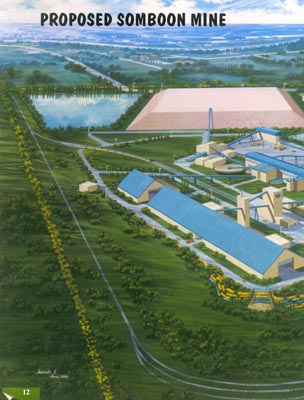

APPC started off with a

concession area of 2,300 sq.km and within three years it was required to reduce

that to 1750 sq. km and two years later it was required to reduce that even

further to 850 sq. km. Within that area it has identified two underground

fields: one is the Somboon; the other, the Udon. The Somboon, which is 15 km

south-east of Udon Thani, has approximately 300 million tons of silvinite

(potash ore). In addition, in the field called the Udon, which is 5 km to the

north of Somboon, there is over 1 billion tons of sylvinite ore. In the Somboon

field, APPC has carried out feasibility studies showing it can support a two

million ton mine for over twenty-five years. And it is continuing its

feasibility studies in the Udon field which could support a second mine and

possibly even a third.

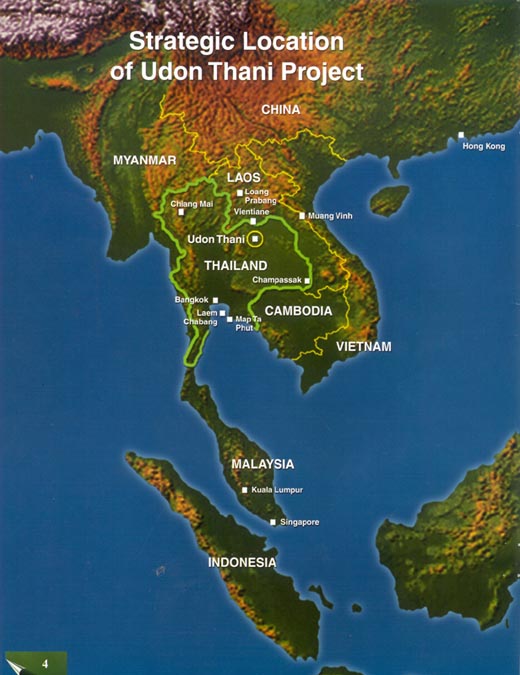

"What is most striking

about the project is first, its location: its distance from a deep-water port

and then its distance to its major customers in South-East Asia. Then, as I

mentioned, the amount of potash consumption in South-East Asia, and more

importantly, the projected increase in consumption. It's a situation you don't

have in North America and Europe where because fertilizer consumption is very

stable if you want to sell more product you have steal someone else's market

share. In Asia though there is plenty of room for this project and its location

gives it a very good start in terms of economics delivered to the customer.

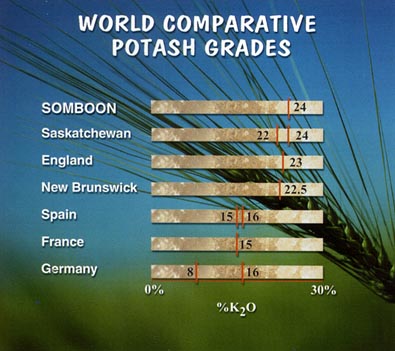

"This is also one of the

shallowest potash deposits in the world which makes it cheaper to mine because

you don't have to go so far underground. We also have an ore grade which is

every bit as good as other mines around the world, and the amount of insolubles

are lower which makes it easier to process. The cost of construction is much

lower in Thailand and ultimately the cost of operating will be similar to

Canadian mines. They have low operating costs because of their size, they have

economies-of-scale, and their high degree of automation.

"In Thailand, we don't

expect the same amount of automation and our mining conditions are slightly more

difficult but we have a significant transportation advantage in that we don't

have to ship by rail 2,500 km to a deep-water port and then ship across the

Pacific Ocean to supply our customers."

Asia-Pacific has also signed an

agreement with Norsk Hydro, a Norwegian company which is the world's largest

finished fertilizer producer. Through its Asian office in Singapore, it has

agreed to market seventy-five percent of APPC's product.

Contact Info:

Tel: (662) 636-1600

Fax: (662) 636-1599

E-mail: dhague@ibm.net

Website: www.crewgroup.com

Finis