WHAT GOES UP MUST COME DOWN

by

Thailand was the fifty-first country that the ratings agency IBCA has rated. Chris Huhne IBCA's managing director says what his company does is advise investors on the likelihood of getting their money back if they buy the bonds of a company, bank, or country. The rating is an assessment of this likelihood e.g. A triple AAA would mean highest quality whereas D would mean in default.

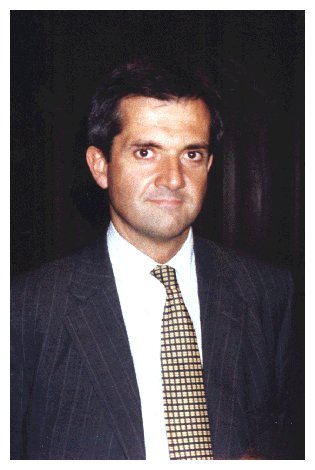

Chris Huhne

The two big American credit agencies are Moody's and Standard & Poor's. Moodys now has Thailand on negative rating watch and it will probably go down to triple B+. Standard & Poor's now rates Thailand at BBB (it was rated at A before the crisis), so it has been downgraded by one.

Mr Huhne says there is nothing special about this crisis. "It is really pretty classic. The main problem was the exchange rate was fixed to the US dollar. So a lot of people were encouraged to borrow in foreign currency which they did, and this caused a lot of debt which fueled the rapidly expanding domestic demand which increased imports and increased the Current Account Deficit and the Balance of Payments.

"Because the baht was linked to the dollar it moved in line with whatever the dollar was doing. From 1991-95 when the dollar was declining against other currencies (particularly against the Japanese yen) it was very felicitious because the Thai baht was becoming cheaper and cheaper in terms of yen. Exporters were finding it relatively easy and exports grew very fast. Then when the dollar soared against the yen, so did the baht. But that made life tougher for the exporters. The belief in the fixed link with the dollar encouraged people to borrow in foreign currency which stoked up spending at home and at the same time squeezed exporters.

"The balance of payments deficit increased with exports stagnating and imports soaring causing investors to believe that the link with the dollar could no longer be maintained. We've seen this happen in quite a number of cases such as in Mexico. There has now been a lot of work done now on the danger of fixed exchange rates and Thailand is a typical example.

"All IMF bailouts work but there is a painful adjustment. After a period where imports are high, and exports are sagging, imports are then cut back and exports boom. This is bad for living standards. The boom period up until the crisis is one where domestic production is diverted into higher living standards as imports are relatively cheap because the exchange rate is high. Then the devaluation comes and the crisis. Then the reverse process has to go on and basically more and more of the output in Thailand has to go overseas. Then the squeeze begins, and it will be painful for two or three years. The miracle won't seem like a miracle. But I don't think the fundamentals are in doubt for the long term. This is just a phase that a lot of countries go through. I think that the Thais got so used to the never ending miracle because the last time they had a serious recession was in the early 80s that they are all rather shocked by it. They are almost in denial.

"Private sector activity by its nature tends unstable. Investment, boom or slump. The confidence of business people deciding whether they are going to invest is inevitably very variable as well. If business people are confident business booms, if they aren't it doesn't.

"There is no such thing as a stable economy which doesn't have cycles. They all do. When the boom is happening people are running around saying there has been a fundamental change, the economy is going to keep on growing at this rate forever, it's absolutely marvelous. When a recession happens people then run around saying it's all a disaster and we are never going to get out of it. The truth is that neither is true. Recessions don't last forever, neither do booms. Economists are reasonably good at predicting how to get round these problems or at least make them less severe. Thailand needs a sound banking system, good and better banking supervision, and macro-economic management that has to look ahead and actually bite the bullet and in Thailand's case that means using fiscal policy more actively than they have in the past especially when are they are faced with these big capital in-flows. They must use fiscal policy to damp down the risk of demand."

Note: IBCA has now merged with the American ratings agency Fitch and the firm is called Fitch-IBCA. They have an arrangement with TRIS, the Thai ratings agency.